Who owns Dave and Buster’s? Do they Franchise?

Dave and Buster’s offers customers the opportunity to “Eat Drink Play and Watch” at the same physical location.

Table of Contents:

Dave and Buster’s operates entertainment and dining venues that offer customers the opportunity to “Eat Drink Play and Watch” at the same physical location. As a full service restaurant, they cater to both adults and families, making it one of the most iconic entertainment brands in the industry.

“The interaction between dining, enjoying our full-service bar, playing interactive games, and watching sports and other entertainment is the defining feature of the Dave & Buster’s customer experience.”

Dave and Buster’s is a recognized name in the entertainment business and has a distinctive brand and appeal. In certain important fields of service, Dave and Buster‘s is rated higher than other major players in the industry, offering a diverse range of entertainment options under one roof:

Pre-COVID, Dave and Buster’s was also expanding and constantly producing strong results, with higher than target Year-One Returns in new franchise locations since 2011. Their revenue was also increasing YoY starting in 2015. The chain was doing very well in terms of dollar figures, attracting qualified investors interested in the current trends of social gaming and entertainment.

Does Dave and Buster’s Franchise?

Dave & Busterʼs is not a franchise in the United States. International franchise inquiries can be submitted to Dave & Busterʼs at Internationaldevelopment@daveandbusters.com

COVID’s Effect on Dave & Buster’s (PLAY Stock)

Total revenue for the company decreased $918,179, or 67.8%, to $436,512 in fiscal 2020 compared to total revenues of $1,354,691 in fiscal 2019. The decline in revenue was attributed to fewer store operating weeks in the fiscal year 2020 as a result of temporary store closures, lower customer volumes due to limited food and beverage, and amusement operations, and the canceling or postponement of special events as a result of the pandemic. Adjusted EBITDA totaled $351,725, or 27.0% of its revenues, compared with Adjusted EBITDA of $308,222 or 22.8% of revenues in fiscal 2019. The increase in Adjusted EBITDA over fiscal 2019 is largely driven by the higher mix of amusements, reductions in hourly labor costs, and reduced discretionary marketing spending.

To deal with the business disruptions and maintain its commitments, Dave and Buster’s sold $185,600 worth of common stock, negotiated amended lending agreements, and mediated with other business partners like landlords, vendors, etc to temporarily reduce payments. At the end of the fiscal year 2021, they had $25,910 in cash and cash equivalents and $492,495 of liquidity available which, coupled with customers returning to their stores, is expected to meet their financial needs for the next Fiscal year.

Stock, and Earnings

Dave and Buster’s stock (PLAY) has performed poorly over the last five years. Investing in Dave and Buster’s stock in 2017 would have yielded lower returns than investing in any of these: S&P 600 Small-Cap, S&P 600 Consumer Discretionary (which is the benchmark for this industry), and the NASDAQ composite index.

Clearly, not only is Dave and Buster’s not performing well enough for it to outperform the market, it cannot even match the growth of the industry benchmark, indicating a lower return than the industry is making. However, the stock is on track to recover from the losses it took during COVID, making a profit of $108 million in the Fiscal Year that ended in 01/2022 compared to a loss of $206 million in the previous Fiscal Year.

| For the Years Ended January 30, 2022 | For the Years Ended January 31, 2021 | |||

|---|---|---|---|---|

| Food and beverage revenues | $436,637 | 33.5% | $159,501 | 36.5% |

| Amusement and other revenues | 867,419 | 66.5 | 277,011 | 63.5 |

| Total revenues | 1,304,056 | 100.0 | 436,512 | 100.0 |

| Cost of food and beverage (as a percent of food and beverage revenues) | 119,123 | 27.3 | 45,207 | 28.3 |

| Cost of amusement and other (as a percent of amusement and other revenues) | 85,848 | 9.9 | 29,698 | 10.7 |

| Total cost of products | 204,971 | 15.7 | 74,905 | 17.2 |

| Operating payroll and benefits | 287,263 | 22.0 | 117,475 | 26.9 |

| Other store operating expenses | 402,661 | 30.9 | 299,454 | 68.6 |

| General and administrative expenses | 75,501 | 5.8 | 47,215 | 10.8 |

| Depreciation and amortization expense | 138,329 | 10.6 | 138,789 | 31.8 |

| Pre-opening costs | 8,150 | 0.6 | 11,276 | 2.6 |

| Total operating costs | 1,116,875 | 85.6 | 689,124 | 157.9 |

| Operating income (loss) | 187,181 | 14.4 | (252,612) | (57.9) |

| Interest expense, net | 53,910 | 4.2 | 36890 | 8.4 |

| Loss on debt extinguishment/refinancing | 5,617 | 0.4 | 904 | 0.2 |

| Income (loss) before provision (benefit) for income taxes | 127,654 | 9.8 | (290,406) | (66.5) |

| Provision (benefit) for income taxes | 19,014 | 1.5 | (83,432) | (19.1) |

| Net income (loss) | 108,640 | 8.3% | $(206,974) | (47.4)% |

| Change in comparable store sales | 199.1% | (70.2)% | ||

| Company-owned stores at end of period | 144 | 140 | ||

| Comparable stores at end of period | 113 | 114 | ||

Dave & Buster’s Merger

On April 6, 2022, Dave and Buster’s announced that they had acquired Main Event, a company that provides “The perfect place for birthday parties, team building, corporate events & parties, meetings & happy hour!” The current CEO of Main Event, Chris Morris, will lead as the CEO of Dave and Buster’s after the merger – a position that was unfilled since September when the previous CEO retired. Dave and Buster’s interim CEO, Kevin Sheehan, announced that Main Event and Dave and Buster’s have a strategic fit that aligns well, but it remains to be seen what elements of its culture are retained by Dave and Buster’s and what changes Main Event’s CEO and culture will bring.

Dave and Buster’s has a large coastal presence that Main Event lacks. Combining both businesses will help because of the combined market research that the two companies have collected over the years from their expansion and growth into their respective markets. The acquisition will reduce competition in the industry and will accelerate growth, considering that the two brands provide complementary services. All of this is not without its downsides, though. Dave and Buster’s stock (PLAY) dropped from $47.71 to $30.72 between 05/04 and 05/24 in 2022. Evidently, the market did not like the acquisition deal and punished the stock for it.

The post-COVID era for PLAY Stock

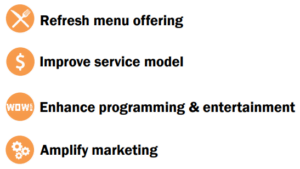

Dave and Buster’s is rebuilding, not from the ground up but, from the first level up with a four-step plan to drive growth:

Dave and Buster’s is planning to refresh menu offerings to reinforce the brand and their food identity and to cater to any consumer preference changes that COVID might have brought about. Additionally, Dave and Buster’s plans to increase the quality of service and improve the execution and speed of service. The entertainment giant believes that it is not making use of technology enough which is evidenced by its re-emphasized focus on launching delivery and virtual kitchens and promoting a closer technological connection between activities at their venues.

Foreign Operations

The entertainment giant also operates two foreign stores in Ontario, Canada. These stores, too, took a hit due to COVID and were hit harder following the more stringent rules regarding the pandemic in Canada. However, only 2% of the company’s long-lasting assets are outside of the USA. Therefore, foreign operations only have a small effect on the finances of the company.

Conclusion

Dave and Buster’s is a strong, household name in the niche business that it operates in. The merger with/acquisition of Main Event is going to lead to better financials for the company as it expands its geographic regionwide presence from coast to coast. While it is not performing well right now, the organization was posting increasing returns before COVID. As with most businesses during the pandemic, Dave and Buster’s, too, took a hit in operations and its profits turned into a loss. This led to a decline in stock price too. However, the entertainment business is picking back up after COVID and so is this one. Even under business pressures generated by COVID, the corporation managed to maintain its creditworthiness and meet its financial obligations without default.

The locations of the company are corporate-owned and other than the two locations in Canada, the annual report makes no mention of any international locations. As such, Dave and Buster’s is not a corporation that employs a franchise model and prefers to keep its establishments fully under its control. With a new approach to their business, new and refreshed offerings, and a consumer base that has been locked away in their homes for what feels like a long time, Dave and Buster’s should start posting higher profits soon, already having posted a profit in the last Fiscal Year.